Unlock Your Entrepreneurial Dreams: Business Startup Loan No Credit Check for Aspiring Entrepreneurs

Guide or Summary:Introduction to Business Startup LoansUnderstanding Business Startup Loan No Credit CheckBenefits of Business Startup Loan No Credit CheckH……

Guide or Summary:

- Introduction to Business Startup Loans

- Understanding Business Startup Loan No Credit Check

- Benefits of Business Startup Loan No Credit Check

- How to Qualify for a Business Startup Loan No Credit Check

- Finding the Right Lender

**Translation of "business startup loan no credit check":**

Business startup loan no credit check

---

Introduction to Business Startup Loans

Starting a business is a thrilling endeavor, but it often comes with its own set of challenges, particularly when it comes to financing. One of the most significant barriers for many aspiring entrepreneurs is securing the necessary funding. Traditional lenders typically require a good credit score, which can be a major roadblock for those who are just starting out or have had financial difficulties in the past. This is where the concept of a business startup loan no credit check becomes invaluable.

Understanding Business Startup Loan No Credit Check

A business startup loan no credit check is designed specifically for individuals who may not have an established credit history or who may have poor credit scores. These loans provide a much-needed financial lifeline, allowing entrepreneurs to launch their businesses without the stress of credit checks. This type of financing is particularly beneficial for those who are new to the business world and may not have had the opportunity to build a strong credit profile.

Benefits of Business Startup Loan No Credit Check

1. **Accessibility**: One of the primary advantages of a business startup loan no credit check is its accessibility. Entrepreneurs who may be turned away by traditional lenders can find opportunities through alternative financing options. Many online lenders and peer-to-peer lending platforms offer these types of loans, making it easier for individuals to secure the funding they need.

2. **Quick Approval Process**: The approval process for a business startup loan no credit check is often much quicker than that of traditional loans. This allows entrepreneurs to access funds faster, enabling them to seize opportunities and start their businesses without unnecessary delays.

3. **Flexible Terms**: Many lenders that offer business startup loans no credit check provide flexible repayment terms. This can help entrepreneurs manage their cash flow more effectively as they navigate the early stages of their business.

How to Qualify for a Business Startup Loan No Credit Check

While business startup loans no credit check are more accessible, it is still essential for entrepreneurs to demonstrate their ability to repay the loan. Lenders may evaluate other factors such as:

- **Business Plan**: A well-thought-out business plan can significantly enhance your chances of securing funding. It shows lenders that you have a clear vision and strategy for your business.

- **Revenue Projections**: Providing realistic revenue projections can help lenders assess your potential for success and your ability to repay the loan.

- **Personal Background**: Lenders may consider your personal background, including your work experience and industry knowledge, to gauge your likelihood of success.

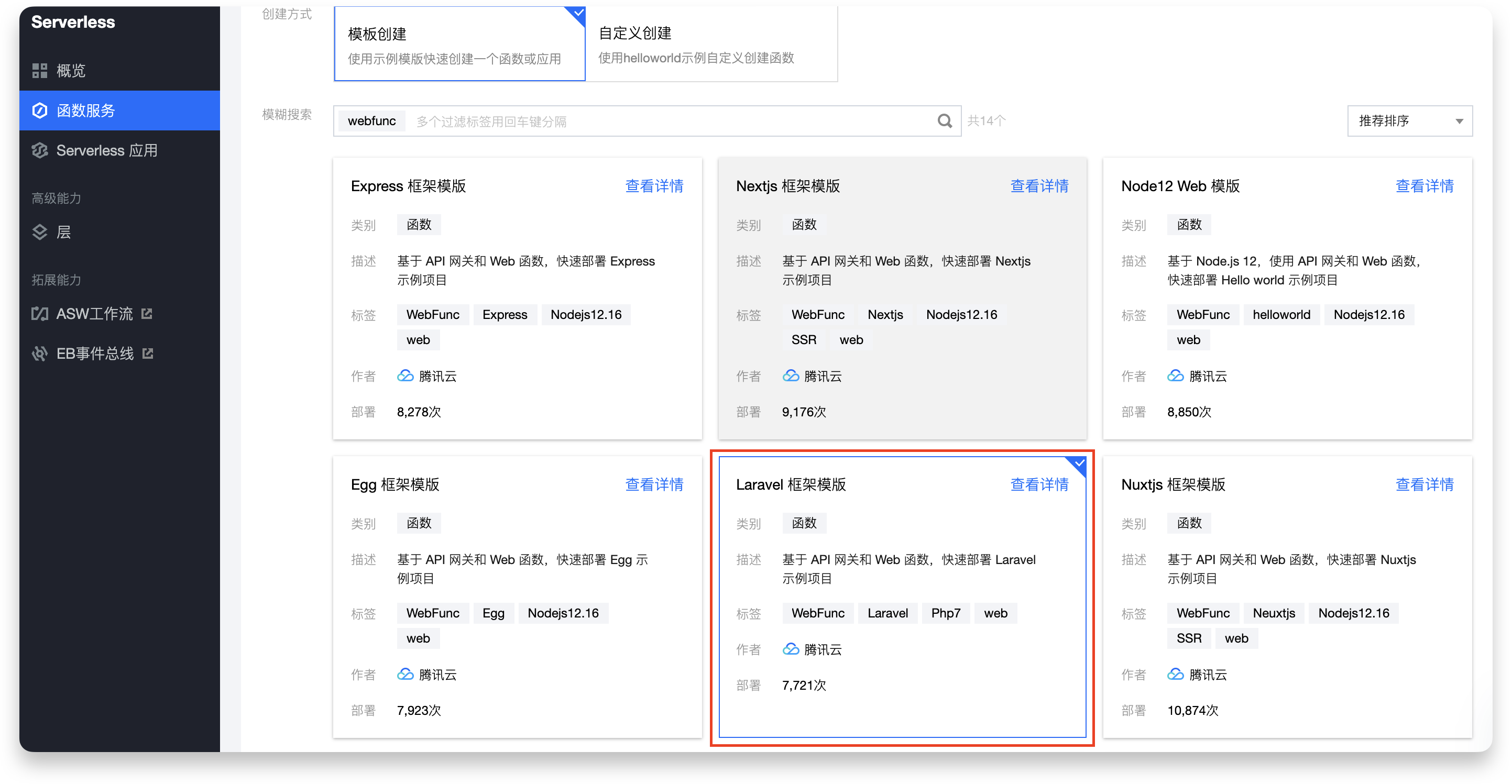

Finding the Right Lender

When searching for a business startup loan no credit check, it is crucial to research and compare different lenders. Look for reputable companies that specialize in providing loans to startups. Read reviews and testimonials to understand the experiences of other borrowers. Additionally, pay attention to the terms and conditions of each loan, including interest rates and fees.

In conclusion, a business startup loan no credit check can be a game-changer for aspiring entrepreneurs who may face challenges in securing traditional financing. By understanding the benefits, qualifications, and the process of finding the right lender, you can take the first steps toward turning your business dreams into reality. Remember, while these loans can provide the necessary funding, it's essential to approach borrowing responsibly and ensure that you have a solid plan in place for your business's success.