### Is a Home Equity Loan Considered Income? Understanding the Financial Implications

When navigating the world of personal finance, one question often arises: **Is a home equity loan considered income?** This inquiry is crucial for homeowner……

When navigating the world of personal finance, one question often arises: **Is a home equity loan considered income?** This inquiry is crucial for homeowners looking to leverage their property’s value for financial gain. In this article, we will explore the implications of home equity loans, how they are treated for tax purposes, and the potential impact on your financial situation.

#### What is a Home Equity Loan?

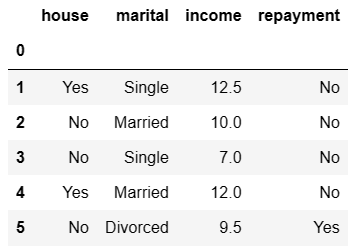

A home equity loan allows homeowners to borrow against the equity in their property. Equity is the difference between the market value of your home and the outstanding mortgage balance. Home equity loans typically come with fixed interest rates and are repaid over a set period, making them a popular choice for funding home improvements, consolidating debt, or covering unexpected expenses.

#### Is a Home Equity Loan Considered Income?

Now, let’s address the central question: **Is a home equity loan considered income?** The answer is no. A home equity loan is not classified as income because it is essentially a loan that you are required to repay. Unlike income, which represents earnings or revenue, a loan is a liability that you must pay back with interest. Therefore, it does not contribute to your taxable income.

#### Tax Implications of Home Equity Loans

While a home equity loan itself is not considered income, there are tax implications that homeowners should be aware of. The interest paid on a home equity loan may be tax-deductible if the loan is used to buy, build, or substantially improve your home. However, recent tax reforms have imposed limitations on these deductions, so it’s essential to consult with a tax professional to understand your specific situation.

#### Benefits and Risks of Home Equity Loans

Home equity loans can offer significant benefits, such as lower interest rates compared to credit cards or personal loans and the potential for tax-deductible interest. However, they also come with risks. Since your home serves as collateral, failing to repay the loan could result in foreclosure. Additionally, borrowing against your home can reduce your equity and financial security.

#### Conclusion

In summary, **is a home equity loan considered income?** The answer is no, but understanding the implications of taking out such a loan is crucial for effective financial planning. Home equity loans can be a valuable financial tool, but they should be approached with caution. Always consider your ability to repay the loan and consult with financial advisors to ensure you are making informed decisions that align with your long-term financial goals.

By grasping the nuances of home equity loans, homeowners can make educated choices that benefit their financial future while avoiding pitfalls that could jeopardize their homeownership.