"FHA Loans vs Conventional Loans: Which Mortgage Option is Right for You?"

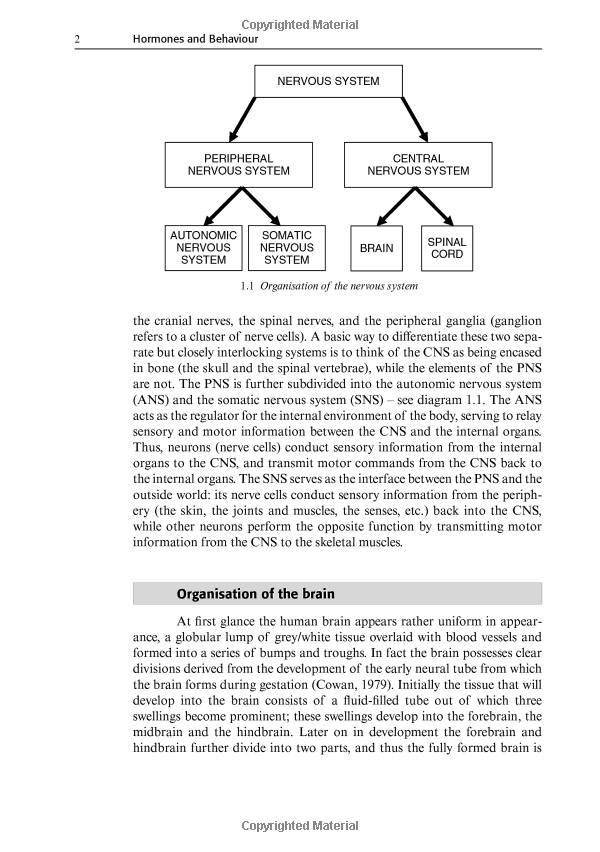

#### FHA Loans vs Conventional LoansWhen it comes to securing a mortgage, understanding the differences between **FHA loans vs conventional loans** is cruci……

#### FHA Loans vs Conventional Loans

When it comes to securing a mortgage, understanding the differences between **FHA loans vs conventional loans** is crucial for homebuyers. Both options have their own set of benefits and drawbacks, and the right choice depends on your financial situation, credit history, and long-term goals.

#### What are FHA Loans?

FHA loans, or Federal Housing Administration loans, are designed to help lower-income and first-time homebuyers qualify for a mortgage. These loans are backed by the government, which means that lenders are more willing to offer loans to those with lower credit scores or smaller down payments. Typically, FHA loans require a down payment of just 3.5% of the purchase price, making them an attractive option for many buyers.

One of the key advantages of FHA loans is their flexibility in terms of credit scores. Borrowers with a credit score as low as 580 can qualify for an FHA loan with the minimum down payment, while those with scores between 500 and 579 may still qualify with a higher down payment of 10%. Additionally, FHA loans allow for higher debt-to-income ratios, making it easier for borrowers to qualify.

However, FHA loans come with certain costs, such as mortgage insurance premiums (MIP), which can increase monthly payments. Borrowers are required to pay both an upfront MIP at closing and an annual premium that is divided into monthly payments. This can make FHA loans more expensive over time compared to conventional loans.

#### What are Conventional Loans?

Conventional loans are not backed by the government and typically require a higher credit score and down payment compared to FHA loans. Most conventional loans require a minimum credit score of 620 and a down payment of at least 5%. However, borrowers who can make a down payment of 20% can avoid private mortgage insurance (PMI), which can save them money in the long run.

One of the main advantages of conventional loans is that they often come with lower overall costs compared to FHA loans, especially for borrowers with good credit. Conventional loans may also offer more flexibility in terms of loan terms and interest rates, allowing borrowers to choose options that best fit their financial needs.

However, the stricter qualification criteria for conventional loans can be a barrier for many potential homebuyers. Those with lower credit scores or limited savings may find it challenging to secure a conventional mortgage.

#### FHA Loans vs Conventional Loans: Which One Should You Choose?

When deciding between **FHA loans vs conventional loans**, consider your financial situation and long-term goals. If you have a lower credit score or limited savings for a down payment, an FHA loan may be the better option. On the other hand, if you have a strong credit history and can afford a larger down payment, a conventional loan may save you money in the long run.

It's also important to consider the total cost of the loan, including interest rates, mortgage insurance, and any potential fees. Consulting with a mortgage lender can help you understand the best option for your specific circumstances.

In conclusion, both FHA loans and conventional loans offer unique advantages and disadvantages. By understanding the differences between these two types of mortgages, you can make an informed decision that aligns with your financial goals and homeownership dreams.