Unlock Your Financial Freedom with a $1000 Instant Loan: Quick Cash Solutions for Emergencies

Guide or Summary:Introduction to $1000 Instant LoanWhat is a $1000 Instant Loan?Benefits of Choosing a $1000 Instant LoanHow to Apply for a $1000 Instant Lo……

Guide or Summary:

- Introduction to $1000 Instant Loan

- What is a $1000 Instant Loan?

- Benefits of Choosing a $1000 Instant Loan

- How to Apply for a $1000 Instant Loan

- Considerations Before Taking a $1000 Instant Loan

---

Introduction to $1000 Instant Loan

In today's fast-paced world, financial emergencies can arise unexpectedly, leaving many individuals in need of immediate cash solutions. A **$1000 instant loan** is designed to provide quick access to funds, enabling borrowers to address urgent financial needs without the lengthy approval processes associated with traditional loans. Whether it's for unexpected medical expenses, car repairs, or other urgent bills, a $1000 instant loan can be a lifesaver.

What is a $1000 Instant Loan?

A **$1000 instant loan** is a short-term borrowing option that allows individuals to receive a loan of up to $1000 quickly and with minimal hassle. These loans are typically unsecured, meaning they do not require collateral, making them accessible to a broader range of borrowers. The application process is often straightforward and can be completed online, with funds deposited directly into the borrower's bank account within a short period, sometimes as quickly as the same day.

Benefits of Choosing a $1000 Instant Loan

1. **Speed and Convenience**: The primary advantage of a **$1000 instant loan** is the speed at which funds are available. Traditional loans can take days or even weeks to process, while instant loans can be approved within minutes.

2. **Minimal Documentation**: Unlike conventional loans that require extensive paperwork and credit checks, instant loans often require only basic information, making them accessible to those with less-than-perfect credit.

3. **Flexibility**: Borrowers can use the funds from a **$1000 instant loan** for a variety of purposes, from covering emergency expenses to consolidating debt or making necessary purchases.

4. **Improved Cash Flow**: For individuals facing temporary financial setbacks, an instant loan can provide the necessary cash flow to navigate tough times without incurring late fees or penalties on bills.

How to Apply for a $1000 Instant Loan

Applying for a **$1000 instant loan** is a straightforward process. Here are the steps you typically need to follow:

1. **Research Lenders**: Start by researching different lenders that offer instant loans. Look for reviews and compare interest rates and terms to find the best option for your needs.

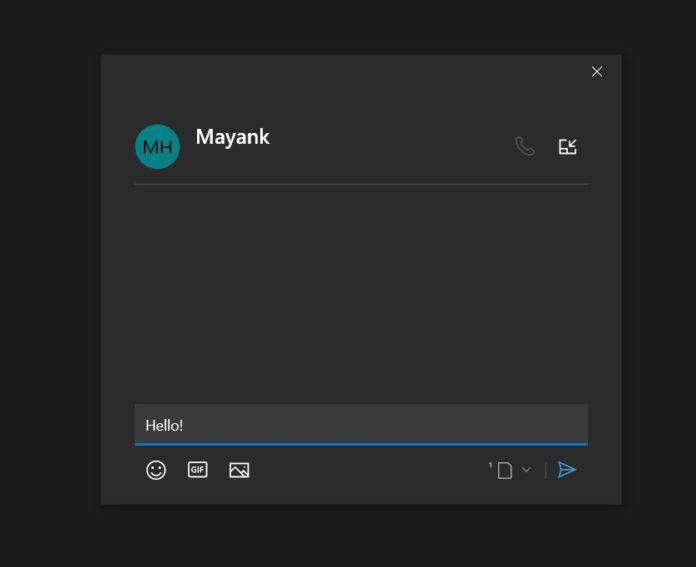

2. **Complete the Application**: Most lenders provide an online application form. Fill in your personal details, including your income, employment status, and bank information.

3. **Submit Required Documents**: While documentation is minimal, you may need to provide proof of income or identification. Ensure you have these documents ready for a smoother application process.

4. **Receive Approval**: After submitting your application, you will typically receive a decision within minutes. If approved, the lender will outline the terms of the loan, including the repayment schedule and interest rate.

5. **Access Your Funds**: Once you agree to the terms, the funds can be deposited into your bank account, often within hours.

Considerations Before Taking a $1000 Instant Loan

While a **$1000 instant loan** can provide quick relief, it’s essential to consider the following before proceeding:

1. **Interest Rates**: Instant loans often come with higher interest rates compared to traditional loans. Make sure you understand the total cost of borrowing.

2. **Repayment Terms**: Review the repayment schedule carefully. Ensure that the monthly payments fit within your budget to avoid falling into a cycle of debt.

3. **Lender Reputation**: Always choose a reputable lender. Check for licensing and read customer reviews to ensure you are dealing with a trustworthy company.

4. **Alternative Options**: Before committing to an instant loan, explore other options, such as borrowing from friends or family, or seeking assistance from local charities or community programs.

A **$1000 instant loan** can be an effective solution for those in need of quick cash. However, it is crucial to approach this financial option with caution. By understanding the terms, considering the costs, and ensuring you can manage the repayment, you can leverage this financial tool to help you overcome temporary financial challenges. Always remember to borrow responsibly, and explore all your options to ensure you make the best financial decision for your situation.