"Ultimate Guide to Using a Calculator for Loan Repayment: Simplify Your Financial Planning"

#### Introduction to Loan Repayment CalculatorsIn today's financial landscape, understanding how to manage loans effectively is crucial for maintaining a he……

#### Introduction to Loan Repayment Calculators

In today's financial landscape, understanding how to manage loans effectively is crucial for maintaining a healthy financial status. A **calculator for loan repayment** is an invaluable tool that helps borrowers determine their monthly payments, total interest paid, and the overall cost of their loans. Whether you're dealing with personal loans, mortgages, or student loans, a loan repayment calculator can simplify the complex calculations involved in repaying debt.

#### How Does a Loan Repayment Calculator Work?

A **calculator for loan repayment** typically requires a few key pieces of information: the loan amount, interest rate, loan term, and payment frequency. After inputting these details, the calculator performs the necessary computations to provide you with a clear breakdown of your repayment schedule. This includes monthly payments, total interest paid over the life of the loan, and the total cost.

#### The Benefits of Using a Loan Repayment Calculator

Using a **calculator for loan repayment** offers numerous advantages:

1. **Clarity in Financial Planning**: By visualizing your repayment schedule, you can better understand how much you need to budget each month.

2. **Comparison of Loan Options**: If you're considering multiple loans, a repayment calculator allows you to compare different interest rates and terms easily.

3. **Early Repayment Insights**: Many calculators provide options to see how making additional payments can reduce the overall interest and shorten the loan term.

4. **Stress Reduction**: Knowing your repayment plan can alleviate anxiety about managing debt.

#### Types of Loans You Can Analyze

A **calculator for loan repayment** can be used for various types of loans, including:

- **Personal Loans**: Unsecured loans that can be used for various purposes, such as consolidating debt or funding a large purchase.

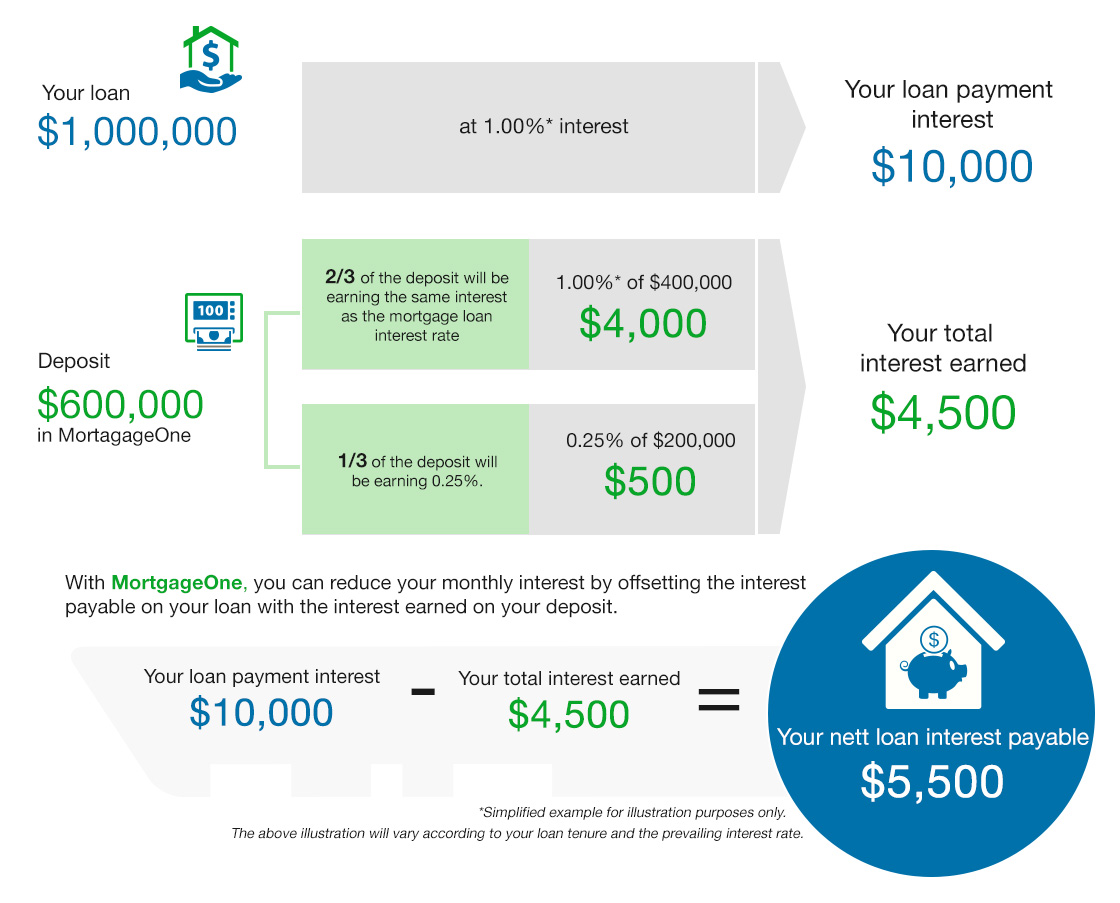

- **Mortgages**: Long-term loans used to buy property, typically requiring a detailed repayment plan due to the large amounts involved.

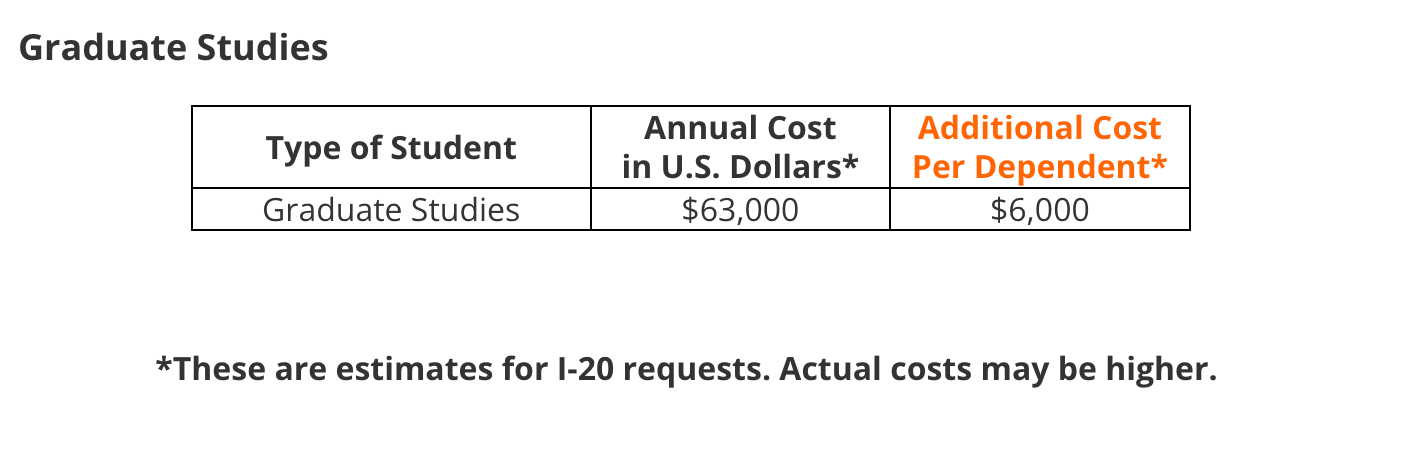

- **Student Loans**: Educational loans that often come with specific repayment options and potential forgiveness programs.

#### How to Use a Loan Repayment Calculator

Using a **calculator for loan repayment** is straightforward. Here’s a step-by-step guide:

1. **Enter the Loan Amount**: Input the total amount you wish to borrow.

2. **Input the Interest Rate**: Provide the annual interest rate as a percentage.

3. **Select the Loan Term**: Choose the duration over which you plan to repay the loan, typically in years.

4. **Choose Payment Frequency**: Decide whether you want to see monthly, bi-weekly, or weekly payment options.

5. **Calculate**: Click the calculate button to generate your repayment schedule.

#### Interpreting the Results

After using a **calculator for loan repayment**, you'll receive a detailed report that includes:

- **Monthly Payment Amount**: The fixed amount you will pay each month.

- **Total Interest Paid**: The total interest you will pay over the life of the loan.

- **Total Cost of the Loan**: The sum of the principal and total interest.

#### Conclusion

In conclusion, a **calculator for loan repayment** is an essential tool for anyone looking to manage their loans effectively. By understanding how to use this calculator, you can make informed decisions about borrowing and repayment, ultimately leading to better financial health. Whether you are planning to take out a new loan or managing existing debt, leveraging a loan repayment calculator can pave the way for a more organized and stress-free financial future.