"Understanding Unsecured Loan Examples: A Comprehensive Guide to Your Financing Options"

#### Unsecured Loan ExampleWhen it comes to personal finance, many individuals find themselves in need of quick cash for various reasons, such as medical em……

#### Unsecured Loan Example

When it comes to personal finance, many individuals find themselves in need of quick cash for various reasons, such as medical emergencies, home improvements, or consolidating debt. One of the most popular financing options available is an unsecured loan. In this article, we will delve into the concept of unsecured loans, provide an unsecured loan example, and discuss the benefits and considerations of opting for this type of financing.

#### What is an Unsecured Loan?

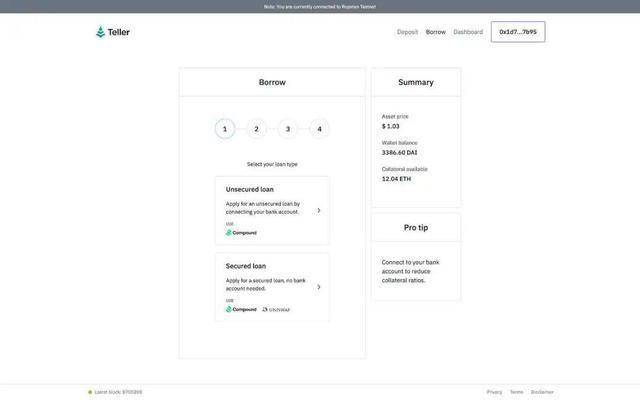

An unsecured loan is a type of loan that does not require the borrower to provide collateral. This means that the lender cannot seize any of the borrower's assets if they fail to repay the loan. Unsecured loans are typically based on the borrower's creditworthiness and income, making them accessible to a wider range of individuals compared to secured loans, which require collateral.

#### Unsecured Loan Example: Personal Loan

To illustrate how an unsecured loan works, let's consider a common unsecured loan example: a personal loan. Suppose Sarah needs $10,000 to cover unexpected medical expenses. She approaches a bank for a personal loan. After reviewing her credit history and income, the bank approves her application based on her good credit score and stable job.

Sarah receives the $10,000 as a lump sum, which she can use to pay her medical bills. Since this is an unsecured loan, she does not have to put up any collateral, such as her home or car. However, she will be required to repay the loan over a specified period, typically ranging from one to five years, along with interest.

#### Benefits of Unsecured Loans

1. **No Collateral Required**: One of the most significant advantages of unsecured loans is that borrowers do not need to risk their assets. This makes unsecured loans an attractive option for those who do not have valuable property to pledge.

2. **Quick Access to Funds**: The application process for unsecured loans is often faster and more straightforward than for secured loans. Borrowers can receive funds quickly, which is crucial in emergencies.

3. **Flexible Use of Funds**: Unsecured loans can be used for various purposes, including debt consolidation, home renovations, or even funding a vacation. Borrowers have the freedom to use the money as they see fit.

#### Considerations When Taking an Unsecured Loan

While unsecured loans offer many benefits, there are also important considerations to keep in mind:

1. **Higher Interest Rates**: Because unsecured loans are riskier for lenders, they often come with higher interest rates compared to secured loans. Borrowers should carefully evaluate the total cost of borrowing.

2. **Impact on Credit Score**: Taking out an unsecured loan can impact a borrower's credit score. Missing payments or defaulting on the loan can lead to a significant drop in creditworthiness.

3. **Loan Limits**: Unsecured loans typically have lower borrowing limits than secured loans. Borrowers may not be able to obtain the full amount they need without providing collateral.

#### Conclusion

In summary, an unsecured loan example such as a personal loan can be a viable solution for those in need of immediate funds without the risk of losing collateral. Understanding the benefits and considerations of unsecured loans is crucial for making informed financial decisions. By carefully assessing your needs and financial situation, you can determine whether an unsecured loan is the right choice for you. Always consider comparing different lenders and loan terms to find the best deal that fits your financial goals.