Cashback Loans Rancho Cucamonga: Unlock Extra Savings with Our Hassle-Free Financing Solutions

---In today’s fast-paced world, financial flexibility is more important than ever. Whether you’re looking to fund a new project, cover unexpected expenses……

---

In today’s fast-paced world, financial flexibility is more important than ever. Whether you’re looking to fund a new project, cover unexpected expenses, or simply want to enjoy some extra cash for a special occasion, cashback loans Rancho Cucamonga provide an excellent solution. These loans not only help you access the funds you need but also reward you with cashback incentives that can enhance your overall financial experience.

### What Are Cashback Loans?

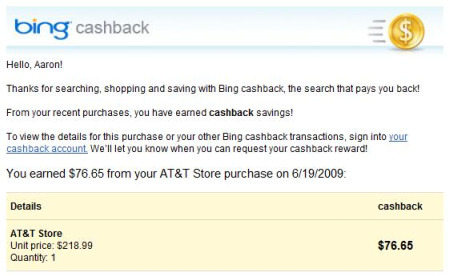

Cashback loans are a unique type of financing that allows borrowers to receive a percentage of the loan amount back in the form of cash rewards. This means that when you take out a loan, you don’t just receive the funds you need; you also get a little something extra. This feature makes cashback loans particularly appealing to residents of Rancho Cucamonga, who may be looking for ways to maximize their financial resources.

### Why Choose Cashback Loans in Rancho Cucamonga?

Rancho Cucamonga is a vibrant city located in San Bernardino County, California, known for its beautiful landscapes, thriving businesses, and a strong sense of community. Residents often find themselves in need of financial solutions that cater to their unique lifestyles. Here are several reasons why cashback loans are an ideal choice for those living in this area:

1. **Local Accessibility**: Many lenders offering cashback loans are based in or near Rancho Cucamonga, making it easy for residents to access in-person consultations and personalized service. This local presence can help borrowers feel more comfortable and informed throughout the loan process.

2. **Flexible Terms**: Cashback loans often come with flexible repayment terms, allowing borrowers to choose a plan that best fits their financial situation. Whether you prefer short-term loans or extended repayment periods, you can find a solution that suits your needs.

3. **Quick Approval Process**: In many cases, cashback loans can be approved quickly, providing you with the funds you need without the lengthy waiting periods associated with traditional loans. This is particularly beneficial for those facing urgent financial situations.

4. **Cashback Incentives**: The most attractive aspect of cashback loans is the cashback feature itself. Depending on the lender, you could receive a percentage of your loan amount back as cash, which can be used for anything from paying off other debts to treating yourself to something special.

### How to Apply for Cashback Loans in Rancho Cucamonga

Applying for cashback loans in Rancho Cucamonga is a straightforward process. Follow these steps to get started:

1. **Research Lenders**: Begin by researching local lenders that offer cashback loans. Look for reviews and testimonials to ensure you choose a reputable provider.

2. **Gather Documentation**: Prepare the necessary documentation, which may include proof of income, identification, and any other information required by the lender.

3. **Submit Your Application**: Fill out the application form provided by the lender. Be honest and thorough in your responses to ensure a smooth approval process.

4. **Review Loan Terms**: Once your application is approved, carefully review the loan terms and conditions. Pay close attention to the interest rates, repayment schedule, and cashback incentives.

5. **Receive Your Funds**: After accepting the loan agreement, you will receive your funds, along with any applicable cashback rewards.

### Conclusion

In summary, cashback loans Rancho Cucamonga offer a fantastic opportunity for residents to secure the funds they need while also enjoying the benefits of cashback rewards. With local accessibility, flexible terms, and a quick approval process, these loans stand out as a viable financial solution for various needs. Whether you’re facing unexpected expenses or simply want to take advantage of extra cash, consider exploring cashback loans as a way to enhance your financial well-being. Take the first step today and discover how these loans can help you achieve your goals while rewarding you along the way.