Understanding the Benefits of Security Service Mortgage Loan for Homebuyers

#### Security Service Mortgage LoanA **Security Service Mortgage Loan** is a specialized financial product designed to help individuals secure funding for p……

#### Security Service Mortgage Loan

A **Security Service Mortgage Loan** is a specialized financial product designed to help individuals secure funding for purchasing a home while ensuring their financial safety and investment security. This type of mortgage loan typically offers competitive interest rates, flexible repayment options, and added security features that make it an attractive choice for many homebuyers.

#### What is a Security Service Mortgage Loan?

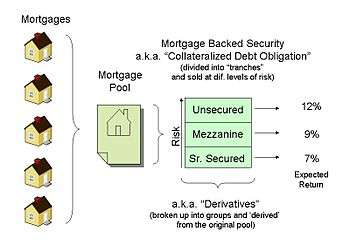

A **Security Service Mortgage Loan** is essentially a loan that is secured by the property being purchased. This means that the lender has a legal claim to the property if the borrower fails to repay the loan. Security service mortgage loans often come with various benefits, including lower interest rates compared to unsecured loans, which can make homeownership more accessible for many people.

#### Benefits of Choosing a Security Service Mortgage Loan

1. **Lower Interest Rates**: One of the primary advantages of a **Security Service Mortgage Loan** is the lower interest rates offered. Because the loan is secured by the property, lenders are more willing to provide favorable terms, which can save borrowers a significant amount of money over the life of the loan.

2. **Flexible Repayment Options**: Many lenders offer flexible repayment plans for security service mortgage loans. Borrowers can choose from various options that suit their financial situation, such as adjustable-rate mortgages or fixed-rate mortgages, allowing them to manage their monthly payments effectively.

3. **Increased Borrowing Power**: With a **Security Service Mortgage Loan**, borrowers may be able to qualify for a larger loan amount than they would with unsecured loans. This increased borrowing power can help homebuyers purchase their dream home without compromising on their needs.

4. **Potential Tax Benefits**: In many regions, the interest paid on mortgage loans is tax-deductible. This can provide significant savings for homeowners, making a **Security Service Mortgage Loan** an even more appealing option.

5. **Home Equity Building**: As borrowers make payments on their mortgage, they build equity in their home. This equity can be a valuable asset, allowing homeowners to access funds through home equity loans or lines of credit in the future.

#### How to Apply for a Security Service Mortgage Loan

Applying for a **Security Service Mortgage Loan** typically involves several steps:

1. **Assess Your Financial Situation**: Before applying, it's essential to evaluate your credit score, income, and existing debts. This assessment will give you a clear picture of what you can afford and help you determine the loan amount you should seek.

2. **Research Lenders**: Not all lenders offer the same terms and conditions for mortgage loans. It's crucial to shop around and compare different lenders to find the best rates and options for your needs.

3. **Gather Necessary Documentation**: To apply for a **Security Service Mortgage Loan**, you will need to provide various documents, including proof of income, tax returns, and information about your debts and assets.

4. **Submit Your Application**: Once you have all the necessary documentation, you can submit your application to the chosen lender. Be prepared to answer questions about your financial history and the property you wish to purchase.

5. **Loan Approval Process**: After submitting your application, the lender will review your financial information and the property details. If approved, you will receive a loan offer outlining the terms, interest rates, and repayment schedule.

6. **Closing the Loan**: If you accept the loan offer, the final step is the closing process, where you will sign the necessary paperwork and officially secure your **Security Service Mortgage Loan**.

#### Conclusion

A **Security Service Mortgage Loan** can be an excellent option for homebuyers looking to purchase a property while benefiting from lower interest rates and flexible repayment options. By understanding the advantages and the application process, potential homeowners can make informed decisions that align with their financial goals and secure their dream home. Whether you are a first-time buyer or looking to refinance an existing mortgage, exploring the benefits of a security service mortgage loan can lead to a more secure and financially sound future.