Unlocking Financial Relief: A Comprehensive Guide to the Maryland Student Loan Tax Credit

Guide or Summary:Understanding the Maryland Student Loan Tax CreditEligibility RequirementsHow to Apply for the Tax CreditMaximizing Your Benefits**Maryland……

Guide or Summary:

- Understanding the Maryland Student Loan Tax Credit

- Eligibility Requirements

- How to Apply for the Tax Credit

- Maximizing Your Benefits

**Maryland Student Loan Tax Credit** (马里兰州学生贷款税收抵免) is a financial benefit designed to alleviate the burden of student loan debt for residents of Maryland. This credit can significantly reduce the amount of state taxes owed, making it an essential tool for graduates struggling with repayment. In this guide, we will explore the intricacies of the Maryland Student Loan Tax Credit, including eligibility requirements, application procedures, and tips for maximizing your benefits.

Understanding the Maryland Student Loan Tax Credit

The Maryland Student Loan Tax Credit is a program aimed at providing financial assistance to individuals who have taken out student loans for their education. This credit allows eligible borrowers to claim a portion of their student loan interest as a tax credit, reducing their overall tax liability. The program is designed to support graduates as they transition into the workforce and begin repaying their loans.

Eligibility Requirements

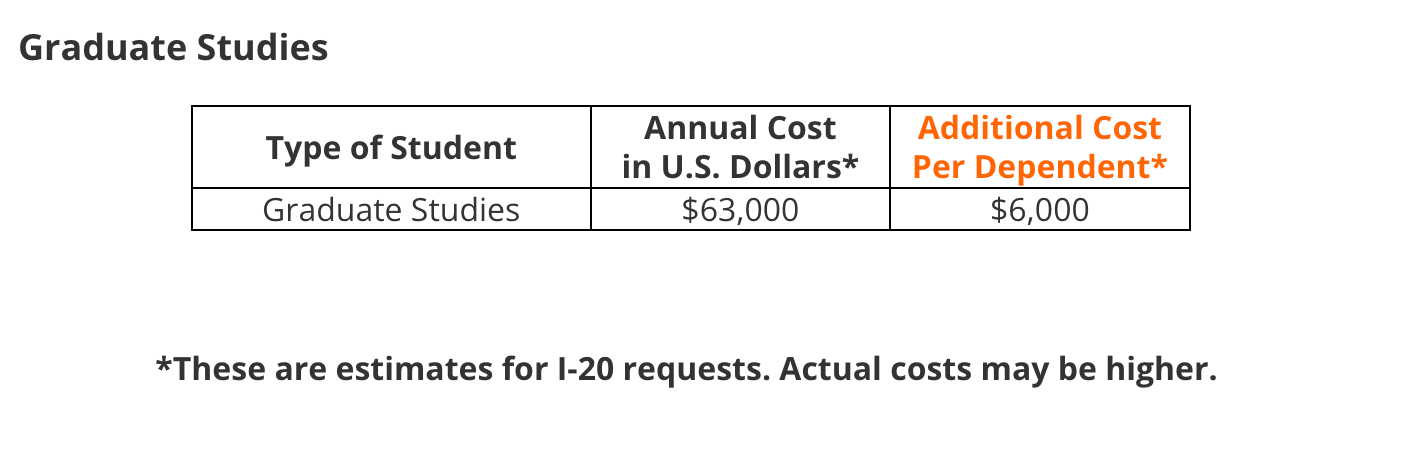

To qualify for the Maryland Student Loan Tax Credit, applicants must meet certain criteria. First and foremost, the individual must be a resident of Maryland and have incurred student loan debt while attending an accredited institution of higher education. Additionally, the loans must be in the borrower’s name, and the borrower must be actively making payments on those loans.

The credit is typically available for both federal and private student loans, but there are limits on the amount that can be claimed. It is essential for applicants to review the specific guidelines set forth by the Maryland State Comptroller’s office to ensure they meet all necessary requirements.

How to Apply for the Tax Credit

Applying for the Maryland Student Loan Tax Credit is a straightforward process. Taxpayers can claim the credit when filing their Maryland state income tax return. It is important to gather all relevant documentation, including proof of student loan interest payments and any necessary forms provided by the state.

The application process may require the completion of specific tax forms, such as the Maryland Form 502 or Form 502CR. It is advisable to consult with a tax professional or utilize tax preparation software to ensure that all information is accurately reported.

Maximizing Your Benefits

To make the most of the Maryland Student Loan Tax Credit, borrowers should keep detailed records of their student loan payments and interest accrued. This documentation will be crucial when calculating the amount of the credit. Additionally, staying informed about any changes to the tax laws or credit eligibility can help individuals take full advantage of available benefits.

Furthermore, borrowers should consider exploring other financial assistance programs, such as income-driven repayment plans or loan forgiveness options, which can complement the benefits of the Maryland Student Loan Tax Credit.

The Maryland Student Loan Tax Credit serves as a valuable resource for residents burdened by student loan debt. By understanding the eligibility requirements, application process, and strategies for maximizing benefits, borrowers can take proactive steps toward financial relief. As student loan debt continues to be a pressing issue for many graduates, programs like the Maryland Student Loan Tax Credit play a crucial role in supporting individuals on their journey to financial stability.